According to Euromonitor International global purchasing of sugar will rise by 14.4 million tonnes by 2020, in absolute terms. In the same period, among 54 countries, seven will increase their per capita sugar consumption by 10 g or more.

The main sources of this growth will be soft drinks, such as carbonates and juice. In some countries, this growth will stem from increased consumption of food/drink high in intrinsic sugars, but even there, if product formulations remain unchanged, the second highest contributors to this growth will primarily be soft drinks.

Florence Schmit, Research Analyst at Euromonitor International offers his comments.

The sugar tax has prompted manufacturers to reformulate their products in advance of the levy in April, by reformulating those brands that belong to the main sugar category ‘culprits’ such as carbonates and juice drinks to reduce their sugar levels below the tax-applicable threshold of 5 g/ 100 ml.

Leading Soft Drinks players in the UK such as Coca-Cola Enterprises and Lucozade Ribena Suntory have reformulated old, and introduced new brands to fall below the sugar levy, such as Coca-Cola’s Monster Hydro energy drink and Suntory’s Lucozade portfolio which has been completely reformulated to avoid paying the higher price.

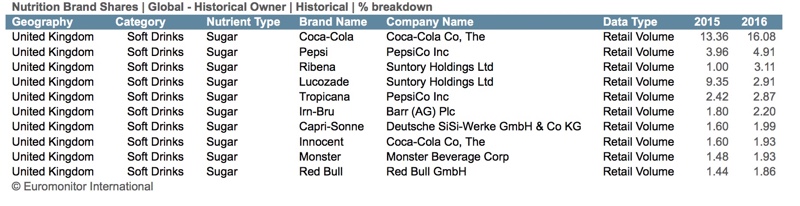

Notably, Coca-Cola, leading player in UK Carbonates with over 40% volume market share of on- and off-trade sales, has stopped short of reducing sugar levels in its Coca-Cola Classic brand, which accounts for 14% of total carbonates volumes, according to Euromonitor International.

It is planning to reduce pack sizes and increase unit prices through off-trade of this brand instead, which will itself propel unit prices overall owing to carbonates’ dominance in the UK Soft Drinks market – accounting for around 45% of total volume sales in 2017.

That said, sales of Coca-Cola Classic in the UK have been declining by double digits in the last five years, suffering from a general trend in the industry towards lower sugar variants in carbonates and Soft Drinks overall.

The sugar tax is thus piggybacking on pre-existing trends, though it will help propel them along: those consumers who were already reducing their sugar content will have more brands to choose from, and those who were not will be nudged towards them either by reduced pack sizes or increased unit prices. And it’s not just Soft Drinks that will be impacted – Foods retailers such as Tesco have been nudged by the sugar tax on Soft Drinks into reformulating own label foods products.

The health and wellness trend in UK Soft Drinks has been particularly pronounced in zooming bottled water sales, with myriad functional water launches, which are set to grow by a whopping 50% in the next five years in volume terms, and propelling the overall Soft Drinks market by 12% in the same period.

It is this burgeoning health and wellness consumer trend which will also help negate any fallout from Brexit – the message is: health and wellness trumps unit price increases. Consumers are willing to pay more for bottles that promise benefit.