It has become clear that the nutritional demands of health-conscious consumers are becoming increasingly aligned with those of athletes

Whether it’s for performance, aesthetics, leisure or health reasons, there are numerous drivers contributing to this global industry trend. However, it has become clear that the nutritional demands of health-conscious consumers are becoming increasingly aligned with those of athletes. As a result, there is now a wide array of products to enhance hydration, boost energy and provide functionality to suit specific requirements in the broader market.

Protein prevails

A strong interest in protein content and high-protein products across the food and drinks market is continuing to develop, fuelled by an increasing consumer understanding regarding the benefits of protein as a critical component of a healthy diet. Nearly 3% of global food and beverage launches in the 12 months ending 31 March, 2014 were marketed on a 'high-protein' or 'source-of-protein' positioning, rising to 6% in the US. In addition to a large number of launches, food products with high-protein claims span a wide array of categories, beyond naturally protein-rich foods such as meat, poultry, fish and eggs. Snacks, for example, dominate the category, followed by meal replacement and other fortified drinks and spoonable yogurt.2

The snackification of everything

Convenience is an overarching trend in the food and beverage market: consumers are increasingly choosing products to fit their hectic and fast-paced lifestyles. As such, manufacturers are required to create innovative products to suit ‘on-the-go’ lifestyles, but which are still nutritionally beneficial to consumers. The snack bar market is one category that has risen to the challenge of this growing demand. Manufacturers are increasingly incorporating ingredients that are high in protein to help boost a bar’s nutritional profile and also to ensure a feeling of satiety, therefore acting as an ideal option for a mid-morning or afternoon snack.

Although today’s consumers expect their foods to have multiple functional benefits, they still have high expectations when it comes to taste and flavour. Formulating cereal bars with high amounts of functional components such as fibres or protein can be difficult, as these ingredients are likely to impact the taste and texture of the end-product.

By using soy protein crisps, or extruded 'puffs', manufacturers are able to customise the level of protein in their snacks while maintaining the crisp and crunchy texture that consumers expect from their cereal bar. Furthermore, isolated soy proteins have a protein digestibility corrected amino acid score (PDCAAS) — a measure of protein quality — that is comparable with animal proteins. As a result, soy proteins are much more effective in delivering high quality nutrition than other commonly used snack ingredients, such as wheat proteins for example.

ADM’s Textura range of soy protein crisps is ideal for snack bar manufacturers who want to create unique products with broad consumer appeal. Depending on their needs, manufacturers can customise the crisps to meet a certain nutritional profile or add exotic flavours, vibrant colours and interesting textures, creating palatable products with wide consumer appeal.

Beverage innovation

Alongside protein-fortified snack bars, protein beverages have also gained popularity as consumers are increasingly aware of their functionality in terms of protein uptake by the body. According to a recent study, liquid forms of protein can achieve peak blood amino acid concentrations twice as quickly after ingestion than solid protein-rich foods, enabling consumers to maximize the rate of muscle protein synthesis.3 Thus, products such as ready-to-drink protein beverages offer a convenient and healthy solution to meet nutritional needs.

formulating with protein can create significant challenges for sports beverage manufacturers

However, formulating with protein can create significant challenges for sports beverage manufacturers. The branched chain amino acid structure of protein molecules means it can often be difficult to create a smooth-tasting beverage. Whey protein, for example, can sometimes impart an unpleasant astringent mouthfeel with cheesy flavour notes, whereas soy proteins can give a slightly beany or bitter flavour. This can pose as a hurdle to the mainstream acceptance of acidic beverages with a high protein content. Consumers also often experience a chalky or grainy mouthfeel when drinking high protein beverages. Achieving the right balance between nutrition, taste and mouthfeel is therefore essential for the product’s commercial success.

A new generation of ingredients

To meet growing consumer demand for great tasting, protein-fortified foods and beverages, new ingredients that echo the benefits of traditional proteins, but are more refined to consumer tastes, have started to emerge on the market. In the beverages category, for example, soy protein isolates can be more nutritionally beneficial than traditional soy protein ingredients when used at the same inclusion level, as they contain more protein per gram. Although similar to soy protein concentrates, soy protein isolates contain reduced amounts of non-protein components. In addition, all soy protein concentrates and isolates are low in saturated fat.

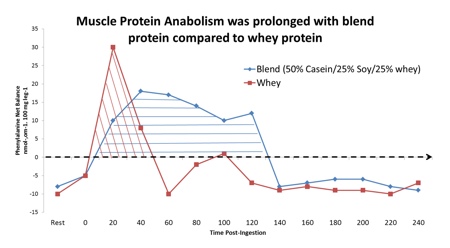

Blending whey protein with a range of other proteins, such as soy and casein, is also becoming more common amongst manufacturers. Although these other proteins have a more moderate digestion rate than whey, some research has shown that they may enable the body to sustain an elevated blood amino acid level during a longer period of time compared with protein solutions based solely on whey. This research supported an extended muscle protein synthesis period of between one and 4 hours during the post-exercise period for the blend used in the study versus whey protein alone (Figure 1).4

Figure 1: Muscle protein anabolism was prolonged with a protein blend compared with whey protein alone

The clean and bland flavour of new isolated soy protein products, such as ADM’s CLARISOY 100, also means that the taste of the finished product is much less impacted by the presence of soy proteins. This appeals to sports drinks manufacturers as it allows consumers access to higher amounts of protein without increasing fat intake or compromising on taste.

Conclusion

manufacturers need to consider the quality of their protein sources to ensure products provide a good balance of both essential and non-essential amino acids

The sports nutrition market has seen rapid growth in recent years, as busy consumers looking for options geared towards healthy, active lifestyles have caused the industry to shed its bodybuilder image. In particular, the advantages of protein are becoming well known among health-minded consumers. When choosing a protein source, manufacturers need to consider the quality of their protein sources to ensure products provide a good balance of both essential and non-essential amino acids, are easily digestible, readily available and low in fat with a neutral taste profile. ADM works with beverage and snack manufacturers to find the best protein options without sacrificing taste or nutrition. As the industry leader in soy protein production, ADM listens to the industry’s challenges and concerns to provide customers with the best solutions for their needs.

References

1. Persistence Market Research, Global Market Study on Sports Nutrition: Asia Pacific to Witness Highest Growth by 2019 (July 2014): www.persistencemarketresearch.com/market-research/sports-nutrition-market.asp.

2. Mintel, “US Consumers Have a Healthy Appetite for High Protein Food. The US Leads the Way in Global Launches of High Protein Products,” January 2013: www.mintel.com/press-centre/food-and-drink/us-consumers-have-a-healthy-appetite-for-high-protein-food-the-us-leads-the-way-in-global-launches-of-high-protein-products.

3. L.M. Burke, et al., “Effect of Intake of Different Dietary Protein Sources on Plasma Amino Acid Profiles at Rest and After Exercise,” Int. J. Sport Nutr. Exerc. Metab. 22, 452–462(2012).

4. P.T. Reidy, et al., “Soy-Dairy Protein Blend and Whey Protein Ingestion After Resistance Exercise Increases Amino Acid Transport and Transporter Expression in Human Skeletal Muscle,” Journal of Applied Physiology 116(11), 1353–1364 (2014).

Figure 1: Muscle protein anabolism was prolonged with a protein blend compared with whey protein alone