In many ways, the US CBD industry is an unstoppable juggernaut. It is already a multibillion-dollar sector that will only get bigger as millions of consumers have made their preferences clear. But, CBD companies still have to navigate many unique hurdles — from obtaining capital to using standard payment processing to being able to market on regular channels.

The crucial developments that will remove these barriers are the US FDA classifying CBD as a dietary supplement, the industry’s unrestricted access to financial services and an intelligent regulatory framework that increases product quality and safety across the board.

According to Nicole Brown, Chief Innovation Officer for Open Book Extracts, during the past year or so, consumers have been seeking to “up level” their lives, take control of their health and utilise preventive and optimisation tools that they can control. People are making more proactive decisions about their overall wellness, which has fuelled an even greater (global) interest into all that cannabinoids have to offer. There are several innovation trends on the 2022 horizon that Brown says will transform the cannabinoid industry for years to come.

Products grounded in research

The efficacy of cannabinoid products in relation to various health conditions has, for a long time, remained up for debate, with scientific research ongoing and many studies having focused on only small groups of participants thus far. But, since 2010, nearly 23,000 scientific papers have been published on the topic; that number continues to grow, which makes cannabinoids now one of the most studied natural remedies in the world.

Radicle Science, a transformative Healthtech B-Corp company offers virtual, direct-to-consumer clinical trials to provide the first ever path to natural product validation at scale. In December 2021, they announced initial findings from the Radicle ACES (Advancing CBD Education and Science) study – history’s largest longitudinal real world evidence (RWE) study of nearly 3000 participants to determine effectiveness of botanical products containing CBD.1

As the most innovative and sophisticated cannabinoid brands pull out all the stops to increase customer confidence, we can expect to see an increase in partnerships between brands and respectable research facilities, such as Radicle Science, to prove just how effective their products are. In 2022, we will see efficacy studies become demonstrative for brand innovation pipelines.

The rise of THCV

As research broadens around other cannabinoids and terpenes such as CBN and THCV, new and rare cannabinoids offering distinct therapeutic benefits will begin to emerge and gain mainstream adoption. THCV is probably the most sought-after cannabinoid on Earth.

THCV is often referred to as the sports car of cannabinoids, diet weed or skinny pot, terms that allude to its effects and rarity. More than a decade ago, THCV investigation was spearheaded by GW Pharmaceuticals who wanted to research its therapeutic potential in metabolic disorders and weight loss. Metabolic issues can cause high blood pressure, blood sugar imbalances, increased abdominal fat and high or low cholesterol.

Since then, animal studies have found that THCV may decrease fat in the liver, balance insulin, reduce hunger cravings, improve bladder control and have therapeutic potential for schizophrenia, Parkinson’s, epilepsy and nausea reduction.2 In human trials, THCV has been found to change elements of brain function related to food intake and improve blood sugar control for participants with type 2 diabetes.2

THCV has been shown to support increases in energy and reduction in appetite, two traits that make it an obvious and attractive candidate for a valuable form of cannabis. This year, brands such as Wana, Cheeba Chews and Temper will launch products featuring THCV to support various desired outcomes in terms of energy, focus and appetite management, and we expect to see a proliferation of THCV products in 2022.

Drinking up

Ingestible products are today’s biggest growth sector in the cannabis community. Given their ease of transport, the dynamism of the beverage category and the likelihood of consumers to experiment with beverages more easily than most other categories, nothing grew faster in 2021 than beverages. They present an alternative to alcohol at social functions and a new product category to attract cannabinoid-curious consumers.

According to BDSA and market research firm IRI, beverages constitute 5% of the CBD edibles market. However, Jessica Lukas, Senior Vice President of Commercial Development with BDSA, the leading market research firm covering the legal cannabis market, expects to see huge growth.

Lukas says: “Beverages are the hot topic. They grew 60% this in 2021 compared with 2020, so it’s huge, but off a very small base.” However, she pointed out, it is a “really important category.” Drinks offer competition, she explained, to other functional beverages as well as to alcohol, as more consumers opt to abstain from adult beverages. BDSA anticipates a $2.5 billion cannabinoid beverage market by 2026.

Beverages also open the door for experimentation and to combine cannabinoids, terpenes and flavonoids to create delicious, endocannabinoid activating experiences. Brands such as House of Terpenes (based in Canada) and American-based CANN pair cannabinoids with complementary flavours and terpenes for a unique drinkable experience. Within beverages, we are likely to see cannabinoids in functional products ranging from seltzers and kombucha, to performance and energy beverages, as well as non-alcoholic cocktails or spirits.

Medical hemp products: CBD with feeling

Most medical marijuana (cannabis) programmes focus on THC, but hemp-derived CBD has many medicinal benefits and is federally legal. This makes CBD of great interest to patients who may not want to experience the intense psychoactive effects of THC-forward products.

Medical CBD products encountered rapid growth in 2021 year, showing no signs of stopping in 2022 and beyond. The demand will continue to grow, particularly as more Boomers and Gen X patients opt for alternative wellness options rather than taking prescription medications.

A new extraction technique that infuses CBD gummies with hemp-derived Delta-9 (potency less than 0.3%), also called CBD with feeling, is becoming increasingly popular. The gummies are compliant because they are less than 0.3% THC, but they will provide a mild psychoactive effect.

Big-box retail access will spur sales while stabilising and improving supply chains

Once companies can market CBD as a dietary supplement, CBD will hit the mainstream of brick-and-mortar retail. In particular, big-box chains will offer a range of topicals and ingestibles in various product categories and applications. However, even in advance of regulations, progressive and pioneering retailers are embracing cannabinoid-enabled products.

In 2020, Vitamin Shoppe was one of the first major retailers to support both ingestible and topical CBD products on their shelves. In 2021, we further saw the opening of distribution for CBD products in the alcoholic beverage channel. All three of the top spirits and wine wholesalers in the US are now active in CBD, with Breakthru Beverage Group entering the CBD and relaxation beverage space through a partnership with Recess, alongside Southern Glazer's Wine & Spirits and Republic National Distributing Company.

This new distribution could vastly grow the market, giving consumers easier and broader access to products on store shelves, as well as driving consumer awareness and education regarding the various benefits of cannabinoid-enabled health and wellness products.

Hybrid plant wellness products

Medicinal mushrooms have been increasingly popular in the wellness space for several years. So, combining therapeutic fungi with plant medicines such as cannabinoids was inevitable. Mushrooms and hemp have complementary benefits, including immune-boosting properties, improved focus, reduced stress and neuroprotective qualities.

Mushroom and CBD blends are currently on the market in several forms, including teas, tinctures and capsules. Popular capsule brand Caps by Cookies combines the medicinal properties of CBD, CBG, CBN and terpenes with the healing powers of Lion’s Mane and cordyceps.

Brand makeovers

Increasingly, consumers are seeking out brands that align with their personal values and thinking more than ever before about just which ones they want to support. With this in mind, we can expect to see some of the first brands to the table having a rethink about how they present themselves, placing greater focus on factors such as sustainability, diversity and inclusion to name but a few.

Gone are the days when we would take what brands say on their labels at face value; consumers are more likely to do their own digging these days to ensure they measure up. In 2022, brands will need to be more transparent to remain in favour and the winners will be those who can do so whilst continuing to stand out from the crowd with efficacious products.

International cannabis market: a burgeoning opportunity

Last year, Open Book Extracts (OBX) noticed an increase in the number of US cannabis operators that are focused on expanding into Europe, Latin America and Africa. Between these three regions, “we are the most bullish about the long-term opportunity in Europe and expect to see a spike in the number of US companies that are levered to the EU in 2022.”

According to the European Cannabis Report (Sixth Edition) by Prohibition Partners, the cannabis market in the EU is forecasted to be a $3.75 billion market by 2025.

The region could quickly prove to be an attractive growth avenue for US operators and OBX is bullish about the long-term potential value that is associated with the region.

When it comes to the hemp and CBD opportunity in Southeast Asia, OBX is highly focused on Thailand. Earlier this year, Thailand’s government passed a bill that legalised the production and use of hemp in products. The types of products that are allowed to contain hemp range from cosmetics to medical supplements. According to the law, products must contain less than 1% THC. A key reason for our bullish view on Thailand is related to how the government issued a limited number of licenses to capitalise on it.

Green wave: cannabis M&A sizzled in 2021 and is poised for a hot 2022

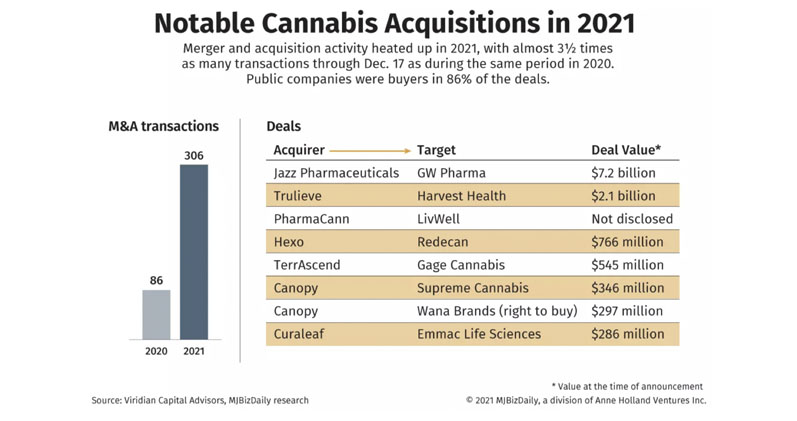

Cannabis merger and acquisition activity proceeded at a torrid pace in 2021 (Figure 1) and could accelerate in 2022 thanks to potential lower interest costs and pressure on larger companies to expand their footprints and boost revenue. New York-based Viridian Capital Advisors counted 306 M&A transactions until 17 December, up more than threefold from the 86 recorded for the same period of 2020, including 209 in the US totalling $10.1 billion in value — with both the numbers and amount exceeding what was recorded in 2019 and 2020 combined.

There were a few blockbuster multibillion-dollar deals in 2021.

- Dublin-based Jazz Pharmaceuticals agreed to buy UK-based GW Pharmaceuticals, one of the largest medical cannabinoid companies in the world, for $7.2 billion. The transaction diversifies Jazz’s commercial portfolio pipeline with therapies that are complementary to its existing business. GW is a proven cannabis biotech firm and has successfully commercialised FDA-approved cannabinoid-based prescription medicines. The acquisition (the largest in the history of the sector) was a landmark transaction for the cannabis industry and increases the credibility that’s associated with it.

- American multinational pharmaceutical and biotechnology corporation Pfizer signed an agreement with the clinical-stage company Arena Pharmaceuticals for a total equity value of around $6.7 billion. Arena Pharmaceuticals is a biotech company with one pipeline dedicated to cannabinoid-type therapeutics. The core of its cannabis operation consists of Olorinab (APD371), which aims to treat patients with diseases affecting the stomach and intestine with an initial focus on visceral pain associated with gastrointestinal disorders.

- Florida-based marijuana operator Trulieve Cannabis acquired Arizona-based Harvest Health & Recreation in a deal initially valued at $2.1 billion.

- Last year’s figures do not include the multibillion-dollar merger of the Canadian cannabis producers Tilray and Aphria, which was announced in late 2020 but completed in 2021.

Acquisitions and mergers will continue, allowing MSOs to get bigger and grow into more markets. We will see more boutique brands emerge, such as the craft alcohol and beer markets, with incredible niche products and great branding. And mainstream companies such as healthcare providers, HR companies, lenders and technology companies who have started taking the cannabis business seriously will be creating segments in their businesses specifically for cannabis.

Concluding thoughts

The cannabinoid market continues to grow, with more and more people exploring how cannabinoid-enabled products can better support their overall health and wellness. And 2022 will be full of surprises for retail, regulations and scientific research and discovery. Companies need to stay well informed and up-to-date on the quickly changing landscape so they can move quickly as rules and regulations change … and as more and more research is released. The more knowledgeable and informed you are, the more you will be able to stay competitive and nimble in the months and years ahead.

References

- www.businesswire.com/news/home/20211207005368/en/.

- www.fundacion-canna.es/en/biological-effects-lesser-known-phytocannabinoids?fbclid=IwAR3RFhUfzHXg03ZY8KyT-FKOI13YYr5Wg_dChgXUSm-xHQFk5kfmGn58uHs.