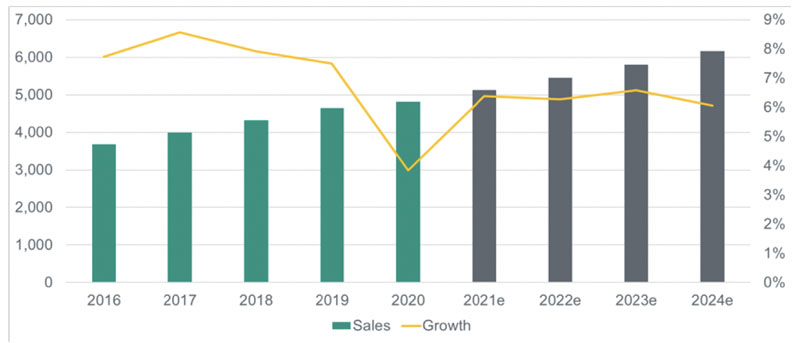

The practitioner channel, as traditionally defined, is a sales route for dietary supplements wherein the seller (or retailer) is a practicing doctor, nutritionist or other accredited healthcare practitioner. These products, although sold through the practitioner channel, are still regulated by the US FDA as dietary supplements and are not FDA-approved as pharmaceuticals (Figure 1).

Figure 1: Consumer sales of dietary supplements ($million): Nutrition Business Journal 2020 Annual Report

The perceived risk of online channel leakage

For much of the last decade, practitioner channel brands have been forced to contend with pressure caused by “channel bleed,” which is defined as the direct-to-consumer sale of practitioner-only products by unauthorised online resellers who sell outside the proper channels, often undercutting authorised practitioners on price. Despite the benefits of in-office visits, online retail is often far more convenient for end users, many of whom buy a majority of their day-to-day consumables online.

Vern Christensen, Managing Director at Partnership Capital Growth, Chairman at Designer Protein and former VP of Strategic Development at Nutraceutical Corporation for many years, highlighted the issue of distribution control, saying: “The control of distribution is a major issue that all brands will face. Distribution growth will become more direct-to-channel (DTC) focused and, hopefully, brands will be able to control where products are sold online and get a better ‘prescription’ model.”

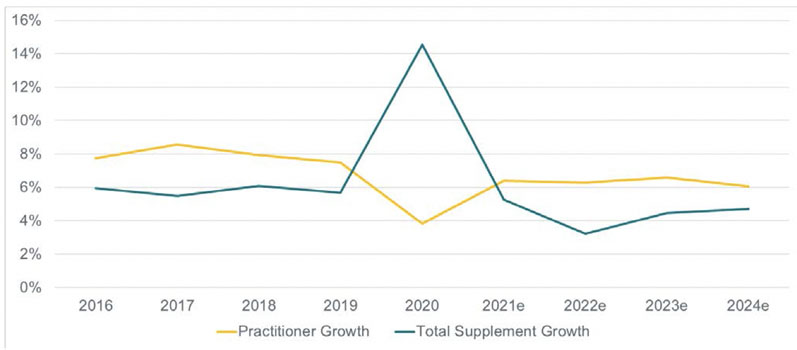

Investors recognise this conundrum. When asked about the biggest challenges to the practitioner channel, Rachel Sexton, Innovation & Strategy Director, Vitamins, Minerals and Supplements at Reckitt, said: “Leakage to online and the need to consider an omnichannel approach regarding how the recommendation can be made for a practitioner supplement and then repeated.” See Figure 2.

Figure 2: Practitioner versus total supplement growth ($million): Nutrition Business Journal 2020 Annual Report

This game actually began more than a decade ago, according to industry expert Edward Hauck of Nutrition Business Advisers. Mr Hauck is also the former CEO of Klaire Labs and the former President of Healthy Directions.

Both Mr Erik Goldman — founding editor of Holistic Primary Care — and Mr Hauck agree that the initial emergence of ebay and then third-party sales on Amazon led to unauthorised resellers providing healthcare practitioner brands. This loss of distribution control has had a negative effect on practitioner brands.

Corrective actions making a difference

Conversations with well-placed industry participants and observers suggest that leading practitioner brands may have turned the corner. Our research during the last 18 months has consistently indicated that the key reasons why the unauthorised resellers made an impact were the product’s low price and its convenience.

As the music industry circa 1999 showed, when consumers could buy something at a lower price with the same (or greater) convenience, they did it, with little regard for the legitimacy of the selling outlet.

One of the key needs, in our view, has been for industry players to work on an ongoing basis to increase convenience and manage any price gaps that exist between legitimate sellers and off-price resellers.

Many top practitioner brands have worked to do just that. A leading executive in the space recently informed us that, today, there’s often just a small price gap between resellers on Amazon and legitimate practitioners. The industry has taken steps to narrow the gap. Mr Hauck confirms that the threat of the “online Wild West” was much greater in 2011 than it is a decade later in 2021.

E-Commerce platform solutions, such as Wellevate by Emerson Ecologics and Fullscript (formerly Natural Partners Fullscript), are putting practitioners on equal ground with questionable Amazon resellers and are levelling the playing field.

This allows the practitioners to offer online ordering and at-home delivery services for those who want them, while maintaining the exclusivity of the clinical setting and the revenue streams that many holistic practitioners need for the fiscal viability of their practices.

It is important to view the challenges presented by channel bleed within a broader context which, overall, is favourable for the practitioner channel. Many people today are dissatisfied with conventional allopathic medicine and seek ways to take personal responsibility for their health and well-being.

Despite challenges getting a good read on industry performance, one well-placed executive said: “We’re about three innings into a nine-inning game, but we do not believe pricing is driving people to Amazon at this point.” Indeed, Roy Chin, Principal of North Castle Partners (a leading private equity investor in the supplement industry and other areas of the health and wellness economy), believes the new hybrid online/practitioner model represents the future of the industry, which he believes has a strong outlook.

This set-up favours brands with perceived quality benefits and strong reputations. Not every manufacturer or brand has sufficient financial resources to create the specific structural changes to sales and marketing that are now needed in the industry.

However, brands such as Designs for Health, Biotics Research, Metagenics and Integrative Therapeutics, have quality attributes, brand development and a demonstrated willingness to adapt. All of these factors should support continued growth as the industry evolves.

The experts we spoke to come from venture firms, private equity companies and larger supplement companies. All of them are highly experienced and have invested in or led supplement companies during the last 20 years.

Although the original respondents noted outsized growth for the practitioner channel, only a few were enthused about putting new investments into the space.

The reason most commonly given was the aforementioned channel bleed and the associated erosion of pricing power and margins. Some even raised an existential question about the long-term viability of the channel.

More recently, we followed up with our sources and found a different story, which suggests the possibility that industry participants have adapted to the new reality posed by the widespread acceptance of online retail channels. Furthermore, the pandemic encouraged the extensive and accelerated use of telemedicine, a new technology that will surely have deep and long-lasting systemic repercussions for the industry.

It is too early to try to quantify the scale of those challenges or opportunities. Despite the nature of the quickly evolving landscape, one important conclusion we have reached is this: investor perceptions about the practitioner channel have fallen behind the reality of what is actually happening, which presents an opportunity for value creation during the coming years.

One investor, Alison Minter, Managing Director of North Castle, has added significant commitment to the space, leading her firm’s acquisition of Vital Nutrients and the addition of Bariatric Fusion during the last 18 months.

Ms Minter notes that the practitioner space is the second fastest-growing channel of vitamins, minerals and supplements (VMS)/nutraceuticals but, because the channel is unknown to many in the investor community, it is easier to find areas to invest in.

She notes: “We think the time to strike is now, particularly while the channel is still in the transformation stage of becoming truly omnichannel. The practitioner category is also fragmented and there are many brands out there with unique, targeted and health-based focus areas that we believe would complement a broader portfolio of practitioner-first brands.”

The lack of data

There is another concern that is frequently raised by investors, which is the lack of accurate data to track the sales transactions that occur within the practitioner channel. The channel currently lacks a broad system akin to the SPINs or AC Nielsen scanner data systems, both in wide use in the retail channel.

Investors we spoke to were not comfortable with company specific claims about their practitioner sell-through. This concern was echoed by Brent Eck, CEO of Metagenics, one of the largest players in the space.

A clear example of the issue is that it took around 6 months for us to learn what the industry sales were for 2020, and we will not be able to assess 2021 until around June of 2022. Explicitly, there is no central data source from which we can collect detailed and timely information that can be used to form analyses on specific brands or products.

More timely and definitive sales data — and a more widely accepted definition for what constitutes the practitioner channel — could support valuation and investor confidence.

This article is an excerpt from a full-length whitepaper published by Green Circle Capital Partners and is reproduced with kind permission.