The greens powder market is growing at a rapid pace. The trend started in the US, where the market is worth $222m, and quickly spread to Europe with launches doubling since 2022.

Research and Markets data suggests that the European greens powder market will see a compound annual growth rate (CAGR) of 7.7% between 2023 and 2030, highlighting the increase in both investment and consumer interest in greens powders across Europe.

But what is driving this growth? Chris Whiting (pictured), European Category Development Manager at Synergy Flavours, reports.

For some time now, the nutrition market has witnessed a shift in consumer buying habits as consumers increasingly take a more holistic approach to health.

Greens powders appeal to these consumers, often citing benefits such as “improved digestion” and “immunity” and calling out specific ingredients such as adaptogens or superfoods.

Usually marketed in a ready-to-mix (RTM) format, the convenience of greens powders also appeals to consumers who may be looking for an easy, on-the-go solution with perceived health and wellness advantages.

Examining products offered by large online retailers (such as Amazon) paints a picture of which ones are performing well and can provide insight regarding where opportunities lie for manufacturers to innovate.

Customer data, such as repurchasing statistics and product reviews, reveal clear patterns in consumer preferences and subsequent buying habits.

For example, Amazon data shows a 343% increase in product reviews for greens powders between 2023 and 2024, which signals a clear increase in purchases.

Furthermore, the percentage difference of good (4–5 star) to bad (1–3 star) reviews has swung in favour towards good (a shift from 58% to 61% and 42% to 39%, respectively), with taste being the most mentioned attribute.

Understanding consumer preferences

The data also highlights that “original” or “unflavoured” products tend to be the most popular with consumers and drive the most repeat purchases.

Although no specific flavour appears on front-of-pack, 21% of products positioned as unflavoured do contain “flavouring” on the ingredients label, according to tracking by Nutrition Integrated.

This suggests that many of these products are utilising taste modulation solutions such as maskers.

Consumer preference for these kinds of solutions is clear: 79% of “plain” or “original” products with “flavouring” listed on the back-of-pack received 5-star reviews; by contrast, only 52% of completely unflavoured products received a 5-star review.

A scientific approach

Manufacturers seeking to tap into this trend must understand how to successfully formulate with greens and overcome taste challenges. Taste modulation is one way that manufacturers can better identify and analyse the challenges inherent in greens powder bases … and identify opportunities to improve their taste.

Taste modulation requires a four-step approach:

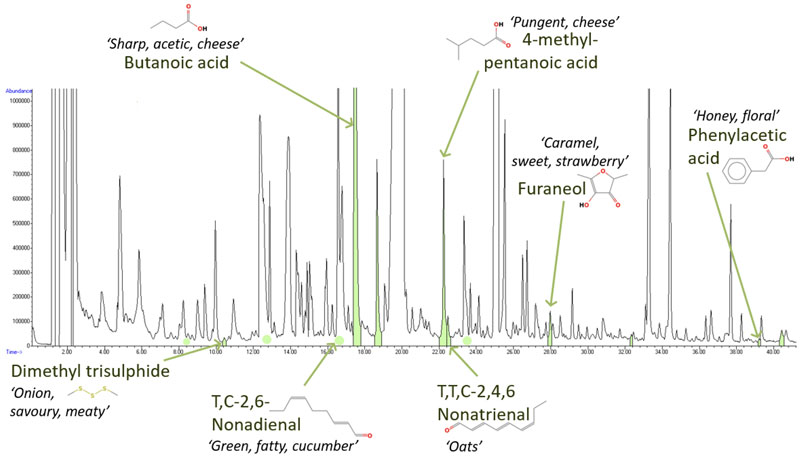

- analyse the base using gas chromatography-mass spectrometry (GC-MS) and gas chromatography-olfactometry (GC-O), a methodology that uses the sense of smell to detect flavour compounds and identify the prominent compounds responsible for certain aromas

- mask and neutralise any undesirable taste characteristics within the base that might impact taste

- identify aroma compounds in the base that are also present in other ingredients/flavours

- pair the neutralised base with flavours that share similar aromatic compounds to ensure the base is balanced with flavours compatible on a molecular level.

Analysing a wholly unflavoured powdered greens base highlights several molecules or flavour compounds that are responsible for certain flavours and taste challenges (Figure 1).

Once these compounds are identified, manufacturers can take corrective action.

Figure 1: Chromatogram highlighting exemplary flavour compounds within a greens powder base; this data is then used to identify potential flavour pairings that share similar molecular compositions

First, any dominant taste challenges, such as astringency (mouth-drying effect), bitterness or thin/watery mouthfeel can be masked to improve the overall perception of the base.

Second, flavour compounds responsible for potent off-notes, such as earthy, green or vegetable, can be identified upon analysis. Similarly, compounds contributing to the overall profile of the greens powder can be investigated.

Food ingredients sharing those molecules are then identified as a potential pairing. For example, the flavour compounds dimethyl trisulfide and butanoic acid, both identified during analysis of the greens powder, are also naturally present in black tea or strawberry, suggesting those two as potential pairings.

Similarly, mango shares at least three flavour compounds with greens powder — furaneol, phenylacetic acid and trans-2,cis-6-nonadienal — suggesting mango as another suitable pairing.

This depth of analysis allows flavour innovation partners to help manufacturers create a signature flavour that complements the natural notes of their greens powder.

What’s next in flavour trends?

As consumer demand continues to grow, so too does demand for new flavours. Data from SPINs shows that tastes such as watermelon, strawberry-kiwi, pineapple and berry have been top sellers in the US for this category.

Other brands may choose to leverage the analysis methodology outlined above to select flavours. Profiles such as tropical fruit or peach iced tea match well with greens powders and are therefore likely to appeal to consumer demand for improved taste.

As consumers continue to take a more holistic approach to health, greens powders that can present health and wellness claims are likely to see continued success in the coming years.

To keep pace with this rapidly growing market, now is the time for manufacturers to expand their existing portfolio or offer a new twist entirely.

Consumer data highlights the importance of taste when it comes to driving repeat purchases; a scientific approach to flavour pairing holds the key to success.