The global melatonin supplements market is entering a decisive "scaling phase," with its valuation projected to grow from $3.3bn in 2025 to $13.1bn by 2035.

According to the latest industry outlook, this rapid expansion represents a compound annual growth rate (CAGR) of 14.9%, fuelled by a fundamental shift in consumer behaviour toward preventive healthcare and non-prescription sleep aids.

According to Future Market Insights (FMI), leading wellness segments, including insomnia management and stress relief, drive a 14.9% CAGR as the industry transitions from niche adoption to mainstream pharmaceutical integration.

As modern lifestyles grapple with rising stress levels, excessive screen exposure and disrupted circadian rhythms, melatonin has moved beyond niche wellness circles.

By 2025, the market will be characterised by wide acceptance across mainstream pharmacies, online retail platforms and major supermarkets, which now account for 42.3% of total distribution.

Strategic market segmentation and primary drivers

The melatonin supplements market 2025-2035 forecast period highlights a market maturing through clinical endorsement and formulation science.

Analysis of end-use industries reveals that insomnia management remains the primary driver, contributing 48.6% of total revenue.

"The market is no longer just about addressing temporary jet lag," the Future Market Insights Report notes.

"We are seeing a sustained demand for daily-use formats that support long-term mental wellness and recovery."

Key sectors influencing revenue include the following:

- sleep disorder management: 30% market share,

- stress and anxiety relief: 18% market share,

- ageing and senior health: 15% market share,

- shift work and travel: 12% market share,

- sports and fitness recovery: 8% market share.

Product innovation: the dominance of tablets and capsules

Technological advancements in delivery systems are a cornerstone of the industry's growth.

The Tablets & Capsules segment is expected to maintain its leadership, commanding 54.7% of the market by 2025.

This dominance is attributed to precise dosing, cost-efficient manufacturing and the integration of controlled-release technologies that improve bioavailability.

While traditional formats lead, the industry is witnessing a rise in "clean-label" innovations.

Leading players such as Natrol, Nature Made, GNC and CVS Health are increasingly focusing on non-GMO, vegan-friendly and high-purity formulations to meet the transparency demands of the modern consumer.

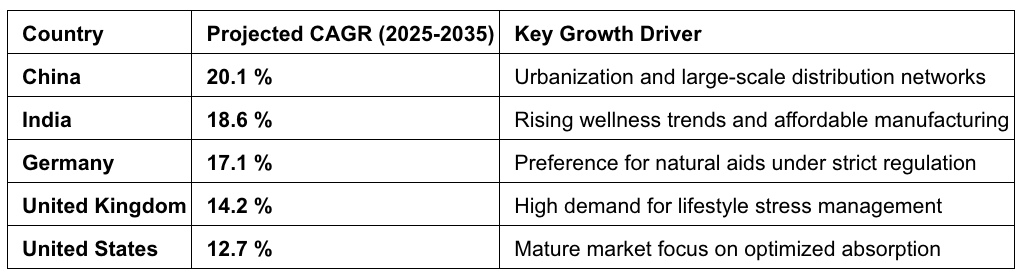

Regional growth outlook: China and India lead acceleration

While North America and Europe remain established hubs for high-quality, clinically tested supplements, the Asia-Pacific region is emerging as the fastest-growing frontier.

Meanwhile, in China and India, growth is propelled by high-stress occupations and a burgeoning middle class seeking natural remedies for sleep latency.

The road to 2035: consolidation and maturity

The decade leading to 2035 will be defined by market consolidation.

Leading brands are expected to strengthen their global footprints through strategic partnerships and supply chain efficiencies, while smaller competitors may pivot toward specialised, high-potency segments.

By 2035, the industry is anticipated to reach a state of "predictable growth," characterised by established international standards for labelling, dosage limits and distribution.

As repeat consumers become the largest market base, the focus for top-tier manufacturers will shift from customer acquisition to long-term retention through product differentiation.