Green Circle is a boutique investment bank that provides advisory services about raising capital and mergers and acquisitions for middle market health and wellness companies. What follows are some highlights from the white paper that we thought our readership might find to be of interest.

The VMS/nutraceutical industry is growing at a very healthy rate, exceeding that of other consumer non-durables such as food and beverages, and dramatically outpacing the growth of the generally sluggish American and global economies.

Certain segments are growing faster than others. Sports nutrition leads the pack with a 10.2% compounded annual growth rate (CAGR) during the last 5 years, with meal replacement at 9.3%, herbs and botanicals at 6.9% and specialties — including products containing ingredients such as probiotics and omega-3 oils — at 5.9%.

Demographic trends

Ageing America supports continued growth: The rate of nutraceutical use increases with age. The ageing of America is the largest contributing factor behind the continued strong growth of the industry.

Nutraceuticals World suggested in a recent article that the percentage of nutraceutical users increases from approximately 45% for those younger than 45 to more than 70% for those older than 65.

The proportion of the US population older than 65 will increase to more than 19% in 2030, from 13% in 2010, according to the US Census Bureau. This shift will bring an additional 32 million people into the over-65 category and should drive incremental nutraceutical adoption.

Product adoption by millennials will further support growth: Perhaps the second most impactful demographic factor supporting growth in the industry is the adoption by younger, millennial consumers.

Acquirers in the space are focused on products that connect with these consumers.

Data from the National Center for Health Statistics shows that during the last 30 years, the percentage of adults older than 20 that use vitamins and supplements has increased from just less than 30% in a survey conducted between 1988 and 1994 to 54% in the most recently available survey, ending in 2014. We believe this trend toward wider adoption will continue.

Specialisation and customisation as tools for value creation

Varying degrees of growth: Despite tremendous progress in the overall nutraceutical industry, are vitamins poised for decelerated growth or even eventual decline?

Vitamins presently account for slightly more than 30% of VMS/nutraceutical industry sales, according to Nutrition Business Journal (NBJ) and anecdotal Green Circle estimates.

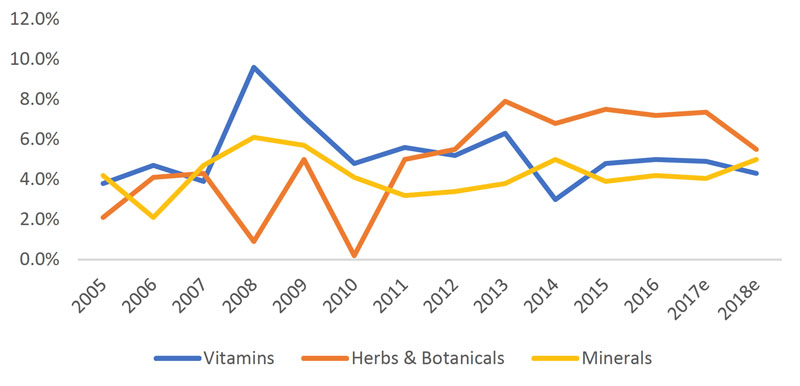

However, growth has been slower than the industry norm, at perhaps 5.6% during the last 10 years. It has been even slower for the last 5 years, at 4.8% (Figure 1). During that time, the vitamin market share of the VMS/nutraceutical category has dropped from 33.4% to 31.2%.

Figure 1: Compounded annual growth rates for vitamins, minerals and herbs/botanicals since 2005 (Source: Nutrition Business Journal)

Trends in vitamins echo what’s happening in these larger consumer categories, as vitamin sales have slowed from CAGRs of 6.8% between 2007 and 2011 to 4.8% between 2012 and 2016.

Many industries would covet 4.8% growth, and we remain bullish on the prospects for the category. Nevertheless, this growth trails the significant, accelerating growth rates enjoyed by other subsegments within the overall industry in recent years.

Be specialised: Specialisation and authenticity carry the day. The nutrition business is faddish by nature, and saying that a certain category such as brain health is hot may be true, as it was in 2016, but it is not necessarily a good predictor of what will be hot in 2021 or even 2018.

Therefore, we must utilise a shorter horizon when assessing industry trends in this space compared with other consumer-facing industries.

“For supplement makers, the key to success in this personalised nutrition world is to innovate and personalise beyond the generic catch-all multilines and develop formulations that target specific consumer groups with specialised lines in all the formats that consumers demand,” reported NBJ.

Product customisation unlocks additional growth opportunities

Growth in the nutraceutical industry has recently been led by categories such as brain health, protein supplements and sleep aids. The era of one-a-day vitamins is gone for many consumers. They tend to seek help for more specific conditions, such as needing more energy or to focus better at work.

Historically, the industry has always been subject to fads, with new products and concepts leading growth for a period before falling back. As is also the case in other wellness businesses, staying on trend is critical to maintaining sales momentum.

Indeed, with the complexity of the industry, it is difficult to forecast which segments will be hot next. We are, however, confident that there will continue to be shifts in consumer spending as new science is released and new trends emerge.

Currently, homeopathic remedies, plant-based treatments and supplements derived from whole foods are gaining momentum. At the same time, previously red-hot superfoods and superfood supplements have cooled somewhat.

One of the trends in healthcare is a general leaning toward customisation. Consumers seek treatments tailored to their specific personal needs and tend to shy away from even proven and viable products if those products are seen as too broad in their indications or as coming from untrusted authorities.

Pursue an omnichannel distribution strategy

This backdrop for solid, long-term growth has supported both small and large manufacturers and distributors of nutraceuticals. We expect this to continue, but exposure to certain channels is preferred, and multichannel penetration may quickly become mandatory.

Sales in nutraceuticals skew towards the older consumer, but the logical strategic focus for additional future growth relies on younger consumers. This sets up a situation wherein brands stand to benefit greatly by having meaningful or even outsized exposure to channels in which younger consumers make purchasing decisions.

Online sales of nutraceuticals have grown to approximately 16% of the market in 2016 from less than 10% in the mid-2000s, according to Nutraceuticals World.

Green Circle believes the share gains have been net accretive to overall sales, which is to say that the online channel is bringing in and stimulating new buyers and new sales that would not necessarily have happened in other channels.

This is distinct from a share grab from brick-and-mortar retailers that might have otherwise been neutral to industry revenue growth overall. Although some sales have, in fact, migrated from brick-and-mortar retail to the online channel, overall, online sales have been far more additive than cannibalising sales generated through traditional retailers.

As today’s 30- and 40-somethings become 50- and 60-somethings in the next 20 years, we believe online will become the dominant channel for nutraceuticals.

Today’s Internet-savvy adults will become Internet-savvy seniors. Not only that, but the Internet channel has the ability to communicate more information and provide more SKUs in the same location, thus supporting the diversified needs of nutraceutical users and brands that sometimes purvey hundreds of items.

It also lends itself to products that require communication with, and the education of, consumers; therefore, it is an ideal fit for the industry.

Emerging and progressive brands seem to agree. “Whether you’re selling to consumers directly or through online channels, communicating what your product is and how it works, and gathering feedback — both supportive and critical — is an essential part of a nutraceutical company’s marketing today. Doing that better is a big part of our marketing plan going forward,” said Claude Tellis, CEO of Naturade, makers of Vegan Smart and other products.

Therefore, one way to enhance the value of any marketer of nutraceuticals is to work toward this technology integrated future.

Our investor colleagues tell us they value science and technology ahead of sales in some cases. Working to solve the gap between the existing online channel and the information and support provided by staff in natural product stores or pharmacies can add significant franchise value.